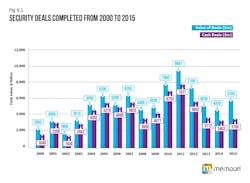

Merger and acquisition in the physical security industry has been on a roller coaster ride over the last 15 years. With an upswing in 2015 that has now continued into 2016, Memoori’s new report predicts that industry M&A will start a new cycle of growth during the next few years.

In 2015, the value of deals increased to $5.7 billion. The two notable deals – Axis Communications being acquired for $2.8 billion by Canon and the merger of Kaba Holdings and Dorma. These two mega deals accounted for more than 80% of the total value of acquisitions this year. However $5.7 billion is still down by 40% on the peak year of 2011.

Now already in 2016 we have seen 2 huge deals;

- Johnson Control’s offer to acquire Tyco International has been accepted by the Tyco board. The deal marks the latest attempt by a U.S. company to reduce its tax bill through a so-called inversion, a maneuver that allows U.S. corporations to acquire foreign-domiciled companies and shift their legal address to reduce their tax rates, in this case Ireland. The premium being offered by Johnson Controls looks reasonable but will it attract other companies to step in with a better offer for the Tyco shareholders?

- Earlier this month, Honeywell announced that they have agreed to acquire smoke detection and security company Xtralis for $480 million. Xtralis pioneered the aspirating smoke detection product and, for a significant time, had no real competition and can now claim the honor of protecting the buildings and staff of many Fortune 500 companies, iconic sites and critical infrastructures worldwide.

In our report on the security industry, we identified both Tyco and Xtralis as one of 50 potential physical security acquisition targets.

The volatility of the last few years has been caused by a number of factors. The first is that the industry underwent a major restructuring from 2009 to 2011 following the 2008 financial crisis.

The second was the lack of confidence and/or interest by the major conglomerates in the business to commit more investment to the industry. However, if the start of 2016 is anything to go by, this confidence has returned.

The third reason is that there has been a shortage of buyers from outside the business, particularly defense and IT.

We would have expected these three factors alone to have resulted in a much greater reduction in the value of acquisitions since its peak in 2011. However, the good news was that acquisition activity in the middle market (mainly populated by specialist-focused security companies) increased in the last three years and this had a significant impact in the underlining 7% growth in deal value (CAGR) over the last 15 years.

The ongoing problems of terrorism and political/economic uncertainty in some regions is making the industry generally confident that investment will continue to flow into the physical security market. Indeed this has been the situation for several years now; and as our report shows, during this time the physical security industry has grown. Our estimated total value of world production of physical security products at factory gate prices in 2015 was $27.2 billion.

In the video surveillance sector, major western manufacturers may well take a serious look at buying a Chinese-based company if they believe this could provide an entry into opening up the China market.

Whether this is possible or practical is debatable as government contracts are still taking the lion’s share of business in this country.

It seems more likely that the leading Chinese manufacturers, who now have significant market shares in some western markets, could have good reason to acquire western companies with leading IP technology at the enterprise level.

It was recently reported that Hikvision has been granted a $3.1 billion debt financing package over the period 2015-2019 by The China Development Bank, one of the three government-owned policy banks.

We believe it is likely Hikvision will complete a major acquisition of a western manufacturer in 2016; assuming that they believe this is the best strategy for growth in western markets. The debt financing provides them with tremendous support to further global expansion and they are even less likely to sit on their hands as good companies are currently being acquired, leaving fewer and fewer opportunities.