The Smart Money: Shifting Solar Energy Market Dynamics

This article originally appeared in the December 2023 issue of Security Business magazine. When sharing, don’t forget to mention Security Business magazine on LinkedIn and @SecBusinessMag on Twitter.

As 2023 winds down, the solar power sector has experienced a significant surge in demand, driven by technological advancements, strategic marketing, and shifting market dynamics; however, this upward trajectory has been accompanied by multi-faceted challenges, making the solar industry's landscape intriguing, yet complex.

The year 2023 marked a pivotal shift in the solar industry, primarily through the increased accessibility of solar panels. Innovative installation methods emerged, enabling panels to be placed in less conspicuous areas of homes, such as carports or awnings. This expansion was further fueled by strategic partnerships with major home improvement and retail stores, effectively bringing solar solutions closer to the consumer.

A significant development in 2023 was the entrance of home security players into the solar market. Companies like ADT and Brinks Home – traditionally known for their security solutions – began integrating solar technologies into their offerings. This move not only expanded the reach of solar solutions but also added a layer of trust and familiarity for consumers, leveraging the established reputations of these security giants.

Concurrently, there was a notable increase in awareness regarding the importance of renewable energy. This awareness was driven by a clearer understanding of the limitations of fossil fuels and the strains on traditional energy grids. Consumers and businesses alike began turning towards solar solutions, influenced not just by environmental concerns but also by a growing trend towards smart, secure, and energy-efficient homes. Solar and storage solutions found a synergistic relationship with smart home technologies, offering enhanced energy management and security features.

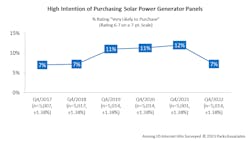

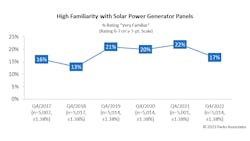

Parks Associates consumer data reveals only 17% of consumers report high familiarity with solar photovoltaic panels. Further, 15% of consumers express a desire to use less energy but lack knowledge on how to achieve this, suggesting an opportunity for the solar industry to provide guidance and solutions.

Legislative actions and shifting social attitudes towards changes in the climate have played a crucial role in advancing solar energy. Government initiatives, including subsidies and pilot programs, have rendered solar energy a viable option across various states. This legislative support arrived at a critical juncture, coinciding with the increasing vulnerabilities of the traditional power grid. Notable power outages in states like California and Texas highlighted the urgent need to develop alternative energy sources, with solar power emerging as a key solution.

Despite its advancements, the solar energy faced notable challenges in 2023. The high cost of solar installations remained a significant barrier, with the substantial initial investment and lengthy ROI period deterring potential adopters. Furthermore, integrating solar energy into existing grid infrastructures posed technical challenges, necessitating advancements in grid management and storage solutions.

The industry also contended with the aftermath of the pandemic, which caused significant supply chain disruptions and raised ethical and economic concerns, particularly regarding dependencies on international suppliers. Although environmentally imperative, the transition to solar energy prompted economic and operational challenges. Moving away from fossil fuels threatened jobs in traditional energy sectors and required significant investment in new infrastructure and public education about the benefits of solar energy.

Solar’s Impact on Construction and the Connected Home

As solar becomes more of a mainstay in the residential market, there will be an increased demand for new houses to be solar ready from construction onwards. Connected device makers will also benefit from an increased presence of solar in the home.

There is significant overlap in consumer segments adopting connected devices and solar energy, and consumers expect and are interested in comprehensive home energy management solutions that can save them money and provide convenience.

For example, Parks Associates’ consumer data reports that on average smart thermostat owners/users save nearly $50 a month on their energy bills. Solutions and policies such as battery storage and net metering enable connected households to increase existing energy savings practices even more. Automation is only as secure as the home’s power source, signifying a likely bond moving forward between smart home platforms incorporating solar panel and battery storage data.

Electrification is now part of the modern connected consumer lifestyle. This represents a new amenity in some states and a required aspect of the home electrical infrastructure in others. In California, new buildings are required to be solar-ready and other states will soon follow suit.

Consumers who say they buy technology as soon as it is available are much more likely to say they own or plan to own home solar systems. Home builders asking for a higher price are including solar. Builders like KB Home, Lennar, Meritage and Pulte have been incorporating solar panels into new homes in California, and several are expanding to other states as well.

Tying it into the Smart Home

Solar and storage represent upsell opportunities for renovators and integrators. Roofers can now install solar shingles, and EVSE installers can offer battery storage as an option to ensure optimum charging even when other major loads in the home are using capacity.

Consumers crave more data on their home electricity usage. Both hardware and smart home platform makers are looking to provide apps, analytics, and meaningful data for consumers to better understand energy consumption and usage. Smart home platforms like SmartThings Energy, Brilliant, and Crestron help consumers understand energy usage and explain actions to take to save energy on a device-by-device basis.

For example, costs can be reduced by closing smart blinds on sunny days and by pausing appliance activity during peak electricity price periods. Including solar and storage in this solution allows the platform and homeowner more flexibility regarding whole home energy usage management. Having battery storage enables homeowners to utilize power throughout the day more efficiently.

Devices like smart plugs and outlets are already giving consumers insights into specific device energy metrics. The inclusion of a solar/storage solution with an overall smart home platform can empower users with real-time data on all the devices in their home.

Solar panels can generate power to charge home storage batteries that support critical loads during a blackout. Advanced technology is enabling systems to anticipate future events and be more prepared.

Looking Ahead: A Crossroads for the Solar Industry

As 2023 concludes, the solar industry is at a crossroads. The technological advancements and legislative support have laid a solid foundation, but overcoming the economic and technical barriers is critical for sustained growth. The industry's ability to address these challenges while capitalizing on the increasing demand for renewable and efficient energy solutions will be decisive in shaping its future trajectory.

Parks Associates forecasts that solar and storage system revenue will grow past $22 billion by 2027. This growth – expected to bounce back from a slight dip between 2023 and 2025 – is predicted to have a Compound Annual Growth Rate (CAGR) of 8.2%.

The potential of the solar market, indicated by consumer interest and projected revenue growth, presents a promising outlook; however, the journey ahead involves navigating the complexities of market education, technology integration, and economic adaptation. The solar industry's response to these challenges and its capacity to innovate and educate will be key factors in determining its success in the years ahead.

Elizabeth Parks is President and CMO of market research and consulting firm Parks Associates. Its report, Solar and Storage: Opportunities in the Smart Home covers key metrics around adoption and purchase intentions for solar and storage solutions, perception of energy costs and renewable energy resources, industry trends, and new market opportunities.

About the Author

Elizabeth Parks

Elizabeth Parks is the President of market research firm Parks Associates. For more information, visit www.parksassociates.com