The Smart Money: Smart Smoke/CO Detection on the Rise

This article originally appeared in the April 2024 issue of Security Business magazine. Don’t forget to mention Security Business magazine on LinkedIn and @SecBusinessMag on Twitter if you share it.

While home energy management, automation, and health applications are appealing to some, the safety and security of the home and its residents continues to drive the smart home market forward. While smart cameras and video doorbells quell the most obvious peace of mind demands of residential consumers, smart smoke/CO detectors serve a similar need.

Parks Associates’ newly released report, Smart Smoke and CO Detectors: Market Assessment 2024 reveals smart smoke/CO detectors generated $771 million in revenue in the U.S. in 2023, with growth projected to reach $976 million by 2027.

There is ample opportunity to grow across sales channels with offerings that show value by integrating into whole-home ecosystems – particularly via partnerships and bundles that offer more value at a competitive price.

Slow but Steady Growth

As smart smoke/CO detector providers expand their product lines, a major focus has been on integration with other security devices and new features, such as indoor air quality detection and leveraging data for prevention. That said, expect slow and steady growth. Smart smoke/CO detectors – like many smart home devices – are not extremely high-growth categories.

Consumers are converting traditional home products into smart products at modest rates each year, and price increases due to inflation have consumer demand across all smart home products down from pandemic highs in 2022 and 2023.

Despite this more negative trend data, the intent to purchase is trending up again. “Like other smart home products, smart smoke/CO detectors experienced a new level of growth during the pandemic, when home renovations were on the rise and personal care and safety were top-of-mind,” says Jennifer Kent, VP of Research for Parks Associates. “While some of these drivers have subsided, moving and renovations remain prime factors to prompt these product purchases. Winning strategies will target consumers at these times, with messaging highlighting the benefits along with the ease of installation when improving your home or moving into a new one.”

Additionally, insurance partnerships for discounted security systems that include smart smoke and CO detectors are also helping to increase product adoption. More investment in smart home space and insurance providers – exemplified by State Farm’s $1.2 billion investment in ADT – should benefit smart smoke and CO detectors, as smoke and fire damage are a leading cause of insurance claims.

With the familiarity of smart smoke and CO detectors gradually rising and being offered in bundled systems, the opportunity exists for continued growth in the next several years. The Matter standard, which promotes interoperability among products, included smoke and CO detectors among nine new device types supported in its 1.2 spec release. This may prompt new-generation product releases and new integrations that unlock additional value for residential consumers.

In general, the consumer base for smart home devices largely consists of segments with incomes and lifestyles that can weather difficult economic times, and inflation is easing in some sectors. Purchase intentions are up for almost all smart home products, and consumers are upgrading their home environment as well.

Integrators Well Positioned

When it comes to smart smoke/CO detectors, residential security integrators are the main sales channel, followed by more traditional retail. Both channels will remain critical – with the likelihood of growth for online channels – while insurance partnerships are an important underutilized channel for device acquisition. Fire and gas leak detection is a top use-case for insurance-provided devices, indicating a key channel for growth.

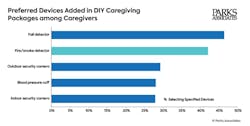

The Market Assessment further notes fire/smoke detectors are among the top three preferred devices for caregiving, as family members/caregivers can check remotely, or be notified if a fire or gas leak is detected at their loved one’s house. These consumers would be responsive to a product bundle including smart smoke/CO detectors and Personal Emergency Response Systems (PERS).

“There is ample opportunity to grow across sales channels with offerings that show value by integrating into whole-home ecosystems and through partnerships and bundles that offer more at a competitive price,” Kent says.

Market Barriers

The steady growth trajectory for smart smoke/CO detectors is tempered by several market headwinds. Macroeconomic conditions still looming from the impact of economic decisions made during the pandemic – such as supply chain disruptions and inflation – plague the market, keeping product prices higher than normal in some sectors and consumer wallets tighter.

For smart smoke/CO detectors specifically, consumers are assumed to have low familiarity. Consumers need to understand the difference between smart detectors over standard offerings to understand and value their benefits.

Inflation is still causing monthly household costs to impact discretionary spending in the short term. Economic uncertainty is high, and recession is still looming, causing households to constrict inessential spending in the long term. Additionally, economic uncertainty is heightened during election years (e.g., 2024).

Rising interest rates and a cooling housing market affect products like garage door openers, sprinkler systems, and in-wall switches that are more likely to be professionally installed. About one-third of smart smoke/CO detectors are self-installed.

This article is based on an excerpt from the Parks Associates research study, Smart Smoke and CO Detectors: Market Assessment 2024. It follows additional research Parks Associates completed on the insurance and smart home device market, Insurance Opportunities in the Smart Home.

Elizabeth Parks is President and CMO of market research and consulting firm Parks Associates. [email protected] • (972) 490-1113

About the Author

Elizabeth Parks

Elizabeth Parks is the President of market research firm Parks Associates. For more information, visit www.parksassociates.com