The Smart Money: Multifamily Access Control Needs

This article originally appeared in the November 2024 issue of Security Business magazine. Don’t forget to mention Security Business magazine on LinkedIn and @SecBusinessMag on Twitter if you share it.

Electronic access control systems – that is, an electronic system that uses electronic keys such as keycards, fobs, or mobile devices to control access via gates or doorways – offer many benefits to multifamily communities. Access control improves the overall safety of the community, preventing theft and property damage, with electronic access control offering greater convenience for residents, efficiency for owners and operators, and enabling new use cases such as self-guided tours, keyless entry for maintenance workers, and advanced guest management functions.

Multifamily properties report different priorities depending on where they are in their technology journeys. Companies that have made the move to mobile credentials and app support are especially interested in features such as video calling from intercoms and enhanced guest management capabilities. Companies without mobile credentials look for Wi-Fi capabilities and integration with smart door locks.

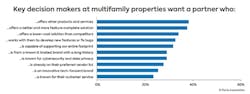

Key decision-makers in the multifamily market – capitalizing on the lessons learned during the last major wave of investment into access control solutions – are honing in on what matters most to them and their companies. This includes integration and simplicity from their partners, as well as feature-complete solutions that can get the job done.

Multifamily Access Control Market Forces and Demands

The movement to new systems – and the shortening of access control replacement cycles – is being driven by several key factors:

Efficiency gains: Improving operational efficiency is the top driver for properties to deploy, upgrade, or replace access control systems. These efficiency gains help companies resolve bottlenecks or do more with less staff, leading to considerable cost savings.

Resident demand: Meeting resident demand, increasing resident satisfaction, and keeping up with neighboring properties are key for attracting and retaining residents. In a Q2 2024 study of MDU residents, Parks Associates found that residents on properties with access control systems that support mobile credentials reported a nearly 20% increase in satisfaction with their property.

Enabling new capabilities: Remote showings and self-guided tours both increase operational efficiencies while allowing prospective residents to visit properties at their convenience, weeding out less interested prospects and improving closer rates for leasing agents.

Addressing safety and security concerns: Parks Associates data finds that 53% of MDU residents in US internet households are far more concerned about the physical security of their homes than they were five years ago. Access control systems act to mitigate these concerns by preventing unauthorized individuals from entering the property.

Package management: Companies are challenged with ever-increasing package, grocery, and food deliveries. Inadequate access mechanisms or storage often results in increased work for property staff, frustration on the part of residents, or potential intrusion into the property by unauthorized individuals. Systems that allow authorized delivery drivers access avoid this pain point.

Aging and broken systems: Systems with performance or reliability issues can force properties to upgrade or replace an access control system at an inconvenient time. It is preferable to schedule a replacement before systems degrade, to prevent any impact to operations or residents.

Rising costs of legacy infrastructure: In many markets, the cost to operate older access control systems and intercoms continues to grow, driven especially by dramatic increases in the cost of legacy telephone service.

How We Get There: Focusing on What Matters Most

Key decision-makers who are more familiar with the access control market and access control brands report different priorities than those who are less familiar, and larger companies report different priorities than smaller ones, reflecting the complexity of the market landscape.

Those who are more familiar with the access control market and access control brands – commonly larger companies – are keenly interested in feature-complete solutions, working with partners capable of supporting their entire footprints, and partners already on preferred vendor lists.

Those who are less familiar – commonly smaller companies – seek partners that offer a complete suite of other products and services, taking away the burdens of integration as well as simplifying the process of vetting and validating new vendors. Smaller companies are more cost-sensitive than larger ones but emphasize the convenience and simplicity of “one-hand-to-shake” above price.

Companies at different stages of their access control journeys likewise have different preferences when it comes to features and functions, with companies at an earlier stage of their journey looking for smart door lock integration and mobile credential support and companies that have already moved to mobile credentials looking carefully towards video intercoms and guest management features for their next round of upgrades.

With increasing operating efficiency, a major business goal for multifamily properties, keeping these factors in mind is paramount when choosing a solution that can deliver and a partner that can do it right. Pent-up demand is signaling the next wave of investments into multifamily technologies, with access control at the forefront.

This article is an excerpt from the Parks Associates whitepaper, Multifamily Access: Riding the New Tech Investment Wave, written in partnership with Chamberlain Group.

About the Author

Kristen Hanich

Kristen Hanich is Director of Research for Parks Associates. https://www.parksassociates.com