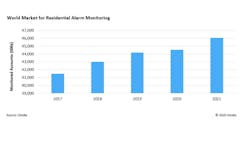

Omdia: Residential alarm market to see reduced 2020 revenues due to COVID-19

According to a new report from Omdia, formerly IHS Markit, the residential alarm monitoring market, which has historically been a recession-resistant industry, will not make it through the COVID-19 pandemic unscathed. In fact, the research firm projects that the global market for residential security monitoring will be flat this year, only growing be a mere 0.8%, which is a full three percentage points lower than originally predicted.

“In both good economic times and bad, consumers have been willing to open their wallets to spend on residential alarm monitoring—driving consistent growth in the number of accounts worldwide,” Blake Kozak, Principal Analyst at Omdia, said in a statement. “However, the COVID-19 crisis is on a completely different scale than previous recessions. Not only has pandemic impacted consumer spending, but mass quarantines have inundated nearly every country across the globe. Consequently, the residential alarm monitoring industry Is destined to experience a sharp reduction in growth for the remainder of 2020.”

Regional Impacts

The impact on the market is not just limited to North America. According to Omdia, the Europe, Middle East and Africa (EMEA) region has seen its expected growth cut by more than half (from 5.6% projected growth down to 2.5%), while the Asian market is predicted to rise by just 1.5%, a significant drop from the previous estimate of 7.6% growth.

Though the U.S. has recently begun a phased reopening of the economy, the research firm said that existing home sales have slowed and are expected to decline by as much as 25% this year, thereby diminishing the installation of new alarm accounts.

On a positive note, installers in the U.S. and elsewhere can rely on the 3G sunset (in order to update cellular back radios from 3G to 4G) to continue entering homes and engaging with customers. Partly because of this, Omdia does not expect major cancellations of existing contracts. Instead, the slowdown will be the result of less new business.

Growth Opportunities

Despite the slowdown in new account growth, Omdia said the level of connectivity within homes today will provide an opportunity for residential security integrators to potentially upsell existing customers. In fact, many alarm companies now are at or near their all-time highs for recurring monthly revenue (RMR). For example, Omdia said that Vivint now has a monthly average revenue per user (ARPU) of nearly $65.

Though do-it-yourself (DIY) systems continue to take market share from traditional alarm providers, the research firm said that they have not yet hit an inflection point with consumers and could even turn out to be a net benefit for professional systems over the long-term as DIY companies change their business models and thus cast doubt over the stability of their brands.

For more information about to Omdia’s, “Residential Remote Monitoring Report – 2020,” click here.