Report: Security industry sees declining M&A values

Editor’s note: This article originally appeared on Memoori.com and has been reprinted here with permission.

Mergers and acquisitions (M&A) data collected by Memoori over the last 18 years shows that the physical security industry has gone through four cycles of growth and decline sometimes exaggerated by a number of billion dollar deals in one year, or increased activity from private equity (PE) or buyers outside the physical security industry.

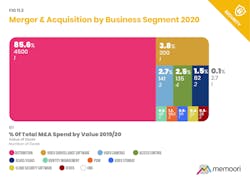

Memoori’s annual world report, “The Physical Security Business 2020 – 2025,” shows that in 2019/2020 (12-month period from Oct 2019 to Sept 2020) the value of mergers and acquisitions fell to $2.91 billion, a reduction of approximately 12% on the 2018/2019 figure. The average annual value of M&A deals over the last 13 years was $6.71 billion, and we believe it will take some time to achieve this level of activity again.

Though there has been a general upward trend in consolidation within the industry over the past 18 years, we have previously experienced volatile changes in M&A activity before. The industry underwent a major restructuring during the period 2009 to 2011 after the 2008 financial crisis. Also, around that period, there was a lack of confidence and/or interest by the major conglomerates (security revenue above $1 billion) to commit more investment to the industry and/or some to divest. More recently, there has been a lack of buyers from outside the business, particularly defense and IT.

Private equity has retained a significant interest in the physical security industry and this year, PE firms have acquired two security companies investing some $200 million, however; this is a modest sum compared with previous years. Competition has heightened and profit margins have fallen in some sectors of the physical security business in the last three years, but overall it has performed well when compared with industry in general. There is still plenty of scope for consolidation and the potential for business growth is high over the next five years.

Within the last seven years there has been a significant trend for medium-sized specialist companies, previously totally dependent on organic growth, to adopt strategic acquisition to speed up growth. These companies are much more focused within each of the three sectors (access control, video surveillance and intruder alarm/perimeter protection) and this is having a significant and beneficial impact on the structure of the market as we have shown in previous years.

The structure of the industry is still very fragmented with hundreds of small companies finding it increasingly difficult to compete and it looks inevitable that the general trend line of value and volume of M&A will regain its momentum over the next five years but at a more modest growth.

Cross border acquisition accounted for 23% of the deals carried out this year compared with 24% in 2018, 32% in 2017, 48% in 2016, 42% in 2015 and 50% in 2014. For the most part over the past 5-year period, the main driver has been the need to extend geographic coverage but this year strategic acquisitions centered around acquiring improved technology products and filling gaps in solutions. Some 73% of the deals involved the acquisition of U.S. companies with the vast majority being domestic affairs.

PE firms have always been attracted to the physical security business and we would expect them to find more opportunities now that the pandemic is waning. During the last two years, some 150 new start-ups have entered the AI software for video surveillance and access control businesses. VSaaS and ACaaS Services need to bolster their finances if they are to meet the growth in demand as they are fast burning their VC Investment cash and IPO’s or SPACs could offer the solution.

So, to conclude, 2019/20 has not been a particularly positive year for M&A but considering the industry has had to cope with the pandemic it is hardly surprising. The industry is now more confident about the future and there appears to be no shortage of finance to leverage future deals.