Report: Video surveillance market proves resilient in wake of Covid-19

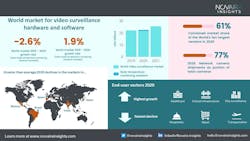

It is sometimes said that the video surveillance market is recession proof. That when economic conditions deteriorate, there continues to be spending on security hardware and software. However, market conditions in 2020 were unprecedented. Restrictions in response to the COVID-19 pandemic meant that many organizations were closed for large parts of the year. Many of them were in sectors which normally invest heavily in video surveillance equipment (e.g. education facilities, banks, airports, retailers, sports stadia, casinos, hotels, fitness centers). It is therefore not surprising that the market for video surveillance hardware and software declined in 2020. However, what is surprising is that the rate of this decline was so modest. A new report from Novaira Insights reveals that the market declined 2.6% in 2020. What is more, the report, “The world market for video surveillance hardware and software” forecasts a rapid recovery and high growth over the next 5 years.

According to lead analyst and founder of Novaira Insights, Josh Woodhouse, “High growth in sectors like healthcare and critical infrastructure somewhat compensated for big declines elsewhere. Also, in early 2020, a market for body temperature monitoring solutions emerged, often sold by video surveillance vendors utilizing their expertise in video. These products provided a short-term boost to their revenues”.

The COVID-19 pandemic was not the only challenge faced by the video surveillance equipment market in 2020 though. Tariffs and trade restrictions also impacted vendors. Woodhouse continued, “Chinese vendors were particularly affected. They faced both U.S. government tariffs on their products and the NDAA ban. However, they and many other vendors were also affected by disruption in the semiconductor market such as HiSilicon being effectively unable to supply semiconductors. This caused big changes in the component supply chain.”

The global market is forecast to grow at 14.3% in 2021 and will be worth an estimated $24.5 billion.

In some markets, such as the U.S., the pandemic acted as catalyst for end-users making greater use of cloud and managed services in their video surveillance systems. According to Jon Cropley, principal analyst at Novaira Insights, “Revenues for software and managed services continued to grow in the U.S. in 2020 while revenues for hardware declined.” Cropley added “In the past decade there have been many acquisitions of video surveillance software vendors. A comprehensive software and managed service offering can provide a path to transforming business models to higher recurring revenues. The transition to recurring revenues is a major industry trend”.

For further information about Novaira Insights and its report, “The world market for video surveillance hardware and software”, click here.