The Smart Money: Residential Security Purchases, Triggers and Channels

This article originally appeared in the March 2022 issue of Security Business magazine. When sharing, don’t forget to mention Security Business magazine on LinkedIn and @SecBusinessMag on Twitter.

In 2021, year-over-year growth in the residential security sector was 15% as reported by consumers – driven by expansion into new areas like energy efficiency and water management solutions as part of portfolios. Being “green” is on the rise, whether it is either through friendly environmental solutions like solar, or through water conservation and leak detection as Resideo has announced.

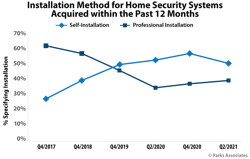

Meanwhile, self-installed systems are enjoying a banner year. Simplisafe earned the highest individual company NPS on ParksAssociates’ 2021 Q2 survey of 10,000 internet households. The security solution offers multiple extensions – such as cameras and lighting – to its core system. Professional monitoring is optional but available at the relatively low cost of $25 per month. Ring, offered by Amazon, is right next to Simplisafe in DIY popularity with its start as a video doorbell.

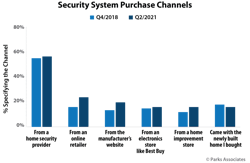

Security system purchases and intentions to buy in 2021 show similar rates as 2020. While “having acquired from a security provider” remains the channel for a majority of security system owners, buying from online retailers and manufacturers’ websites are increasing in importance. Online retail as the channel for security system owners has increased 45% in the past year!

The top trigger to purchase is owners acquiring their system by moving into a home where it was already present. Burglary or other incident at the home or an incident at a friend or neighbor’s home tie for second place. Given the lower rate of crime now compared to the past, it is a bit surprising to see these triggers increase. Therefore this points to low peace of mind among households, and perhaps wider awareness of break-ins beyond one’s immediate vicinity, with previously local news shared much farther geographically due to social media.

When it comes to security system features that consumers want, interactivity and central stations that can dispatch first responders earn the highest ratings. Professional monitoring and interactive services continue to form the core and foundation of a systems’ value, as video product integration is a growing must-have and opens the door to new video storage and monitoring service revenues.

Professionally monitored households report high interest in multiple add-on services. The highest interest accrues to fire and gas safety, and then PERS. While PERS is traditionally thought of as an elderly use-case, there is an opportunity to provide personal safety services to all age groups – particularly runners, hikers, those working night shifts or in isolated circumstances. ADT Go, for instance,offers a personal safety app with a freemium model.

Security system purchase preferences have not changed significantly since 2018. The bulk of intenders want access to smart home devices, and the majority seek to purchase online or from a store. Historically, a higher percentage of buyers have purchased from a dealer than via retail. Among those intending to purchase a security system, DIY systems are highly desirable and smartphone interactivity is a near must.

Finally, to continue the industry’s growth path – either in customers, revenues or both – demands that they lean into the edge. Active expansion efforts to gain new channels and partners is part of that lean-in requirement. Using smart assistants and smartphones for control is nearly table stakes for any provider seeking to be viewed as current. Having available smart home devices at the ready is also important. Security solution providers must understand their past and potential to develop compelling products and effective marketing strategies.

Security solution providers must understand their past and potential to develop compelling products and effective marketing strategies. The study Security Buyers: Purchase Trends and Triggers (www.parksassociates.com/marketfocus/security-purchase-triggers) quantifies security buyers’ purchase trends and triggers – including drivers and barriers, influencers, purchase channel preferences for product and service bundles, purchase processes, and importance of incentives, such as discounts, financing, or rebates from an insurance provider.

Elizabeth Parks is President and CMO of market research firm Parks Associates. For more information about Parks Associates research, visit www.parksassociates.com.