This article originally appeared as the cover story in the March 2022 issue of Security Business magazine. When sharing, don’t forget to mention Security Business magazine on LinkedIn and @SecBusinessMag on Twitter.

Back in 2009, the broadcast television industry moved from analog technology to digital, paving the way for many other industries to follow suit. The security industry, for once, was ahead of the curve in this regard, as Axis Communications invented the first network video surveillance camera in 1996.

Over the years, the common refrain in the security integration industry has increasingly moved from “analog is still half my business” to “analog is dying” to the current, “analog is dead.”

I talked to several consultants and integrators who all told me unequivocally that they never even consider specifying analog technology when working with clients.

But here’s the thing: There are several situations where today’s high-definition analog (HD Analog) camera technology can be more advantageous than IP cameras from both cost and surveillance effectiveness perspectives.

Conceptually, investing in analog surveillance may seem like taking a technological step backward; however, for some end-users, reusing existing analog cameras and cabling or adding modern analog cameras can actually mean taking four steps forward in terms of cost savings, cybersecurity, camera coverage and use of video analytics.

Thanks to new benefits provided by modern analog video technology, integrators and consultants should at least realize that analog is making a zombie-like return from “the dead” to provide real benefits for certain niche applications and cabling infrastructure situations.

The Rise of High-Resolution Analog Cameras

In recent years, high-definition analog (HD Analog) cameras have arrived in high megapixel resolutions up to 8MP (4K Ultra HD) that have impressive WDR (Wide Dynamic Range), low-light and other capabilities formerly found only in IP cameras, making HD Analog suitable for a wider range of applications than the earlier generation of standard definition analog video.

These modern HD Analog cameras can reuse existing coax cable, because coax is designed to carry much more signal than what is required for a single standard-definition analog camera. Coax cable (RG59) runs of 1,600 ft. are possible, including PTZ control over coax, and power over coax (PoC). Amplifiers can extend the cable runs up to 4,000 ft.

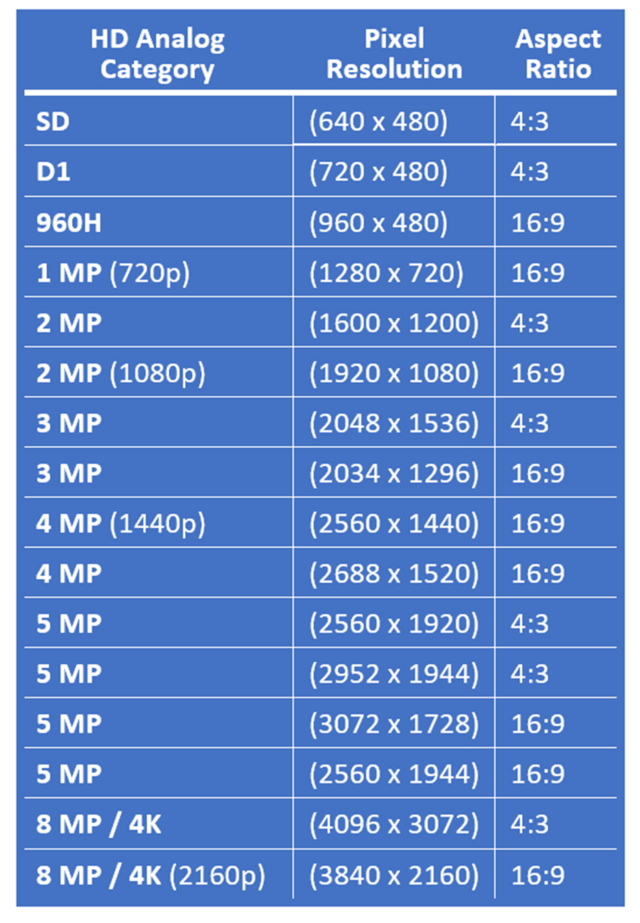

By using high resolution camera sensors, some HD Analog cameras provide full-size 4:3 or 16:9 aspect ratios, where the 4:3 resolution is not a cropped-down version of the 16:9 wide image (i.e., no loss of overall image pixel count). Thus, HD Analog camera resolutions now include a wide range of image resolutions (Scroll down to the end of this article to see the chart in the sidebar).

The 2, 3, 5 and 8MP resolutions provide integrator and end-user a choice between the 16:9 wide resolution and the squarish 4:3 standard definition resolution to better fit the requirements for each surveilled scene.

It is important to understand that although these technologies were designed primarily for coaxial cable transmission, their signals can also be transmitted over fiber optic cables by using fiber video converters – providing higher bandwidth for signal transmission and low cybersecurity risk for the fiber optic segment of the data transmission.

HD Analog formats have often been varied and complex (as noted in the sidebar following this article); however, those complexities have diminished in impact with the arrival of 4-in-1 cameras that support CVI, TVI, AHD, CVBS resolutions from 2MP up to 8MP, and sometimes include SDI support up to 5MP.

This makes 4-in-1 cameras compatible with DVRs that support one or more of the four standards.

Many currently-deployed DVRs do not support megapixel resolutions more than 2MP, unless they have been recently purchased.

The Advantages of HD Analog

When considering HD Analog vs. IP networked technology, analog can offer several advantages, including:

- Lower costs for customers – Lower new equipment cost and lower total cost of ownership.

- Simpler cybersecurity – Analog cabling is cyber-secure by its nature (i.e., not network-connected) while being less costly than long Ethernet network runs.

- More camera coverage for the cost – Lowered camera and cabling costs enable the acquisition and deployment of more cameras. Megapixel HD Analog cameras can cover large areas with fewer cameras in many cases.

- More video analytics – Cost savings can mean that modern video analytics can be applied to more cameras – both new and existing.

More on Cost Factors and Potential Savings

HD Analog camera costs are significantly lower than comparable IP cameras, because HD analog cameras do not contain a computer board, an operating system, application software or network interface chips. This sheer lack of complexity significantly lowers the Total Cost of Ownership (TCO) for the end-customer and Total Cost to Serve (TCS) for the integrator. (Editor’s Note: Take a deep dive into TCS for integrators in Ray Bernard’s Security Business January 2019 cover story: www.securityinfowatch.com/21038732).

8MP HD Analog 4-in-1 cameras range in price from $50 to $250, depending on various camera features such as WDR, low-light performance, audio capability, lens type, I/O, IR illumination, Power over Coax and PTZ control over coax.

A variety of manufacturers offer HD Analog to IP video encoders (H.264, H.265) in a range of capacities including single-, 4-channel, 8-channel and 16-channel encoders. They range from $50 to $100 per camera channel, including encoders that support 4MP and 8MP resolutions. With a camera + encoder cost between $100 and $350 – an 8MP HD Analog camera can cost $1,000 less than an equivalent-featured IP camera.

IP cameras require a lot of processing power to convert the camera’s images into highly compressed H.264 or H.265 video streams – something analog cameras do not need to do. Some VMS software licenses have lower pricing per-camera for encoder-connected analog cameras vs. IP cameras.

Because they are not computers, but instead are primarily image capture devices, HD Analog cameras are simpler to manage than IP cameras. The fact that IP cameras are essentially computers adds additional complexity, such as password management and firmware updating for each camera, as well as vulnerability to cyber- attack – all challenges that analog cameras simply do not have.

Reuse of Coax

The reuse of existing coax cable infrastructure is a source of significant cost savings for end-customers, as well as major labor and installation time saving for integrators; however, to do so requires a thorough inspection of the cable before reusing it.

Cloud VMS provider Eagle Eye Networks recently published a best practices guide for upgrading existing analog video surveillance systems, entitled

“Analog Video to Cloud” (get it at www.een.com/analog-video-to-cloud). The guide highlights the importance of inspecting and qualifying existing coax cable: “There can be many unseen factors that compromise coax cable infrastructure, even though the existing analog video system seems to be working,” the guide explains. “Rodents can feast on the cable insulation, over time exposing internal cable elements to water compromise and deterioration due to corrosive elements. Cables can be progressively weakened to the point where they break at areas of greatest damage. New sources of radio frequency interference can arrive, such as through the installation or relocation of power transformers or other electrical equipment close to the cable run.”

The guide goes on to instruct integrators to verify the cable meets requirements for three key characteristics to make it HD Analog-worthy:

- The impedance rating must be 75 ohms, as opposed to 50 or 93 ohms.

- The inner conductor should be pure copper, not copper clad steel.

- The cable should be shielded to prevent electronic “noise” from reaching the copper wire in the center of the cable that carries the video signal.

In addition to using a coax cable tester, another important part of preparation includes educating the customer on the potential disqualifiers to cable reuse, and then briefing the customer on what the cable assessment revealed. Most customers understand and accept conditional cost increases based on cable disqualification in the contract, knowing in advance that there may be variations from site to site in the percentages of existing cable reuse and new cable installation.

IP Integration Brings in the Analytics

Integrating analog video into IP systems enables the application of deep-learning based video analytics; and the cost savings over IP camera alternatives can fund the addition or expansion of video analytics for all cameras – both analog and IP – for on-prem or cloud-based systems.

Well-engineered cloud-native video analytics platforms are an excellent way to incorporate video analytics without having to upgrade or install new on-premises computing. Cloud systems can automatically expand and reduce the processing power available for analytics computing – a capability that is not feasible to establish using on-premise equipment.

Some smart high-definition video encoders provide basic motion detection analytic functions, such as cross-line detection, and they can send email alerts in response to a motion event regardless of where the IP video stream is being sent – to an on-premise VMS or to the cloud.

Some video encoder appliances support hard drives for short-term video recording, and also include email alerting capability. This can add needed functionality to remote sites without having to add local computers.

Another interesting use-case for analytics powered by HD Analog is illustrated by cloud-based analytics provider Calipsa (www.calipsa.io), which focuses on false alarm reduction for large video-capable central stations and internal alarm monitoring operations.

For remote facilities with analog cameras, the addition of an IP video encoder with basic analytics and email alerting capabilities provides a way to add Calipsa’s false alarm filtering and analysis that would otherwise be impossible without on-premise computing capabilities. (Editor’s note: For more insight on how Calipsa’s AI works for false alarm reduction, check out our October 2020 profile of the technology at www.securityinfowatch.com/21154542) .

Customers to Target

Analog is indeed dead for new video projects today – the vast majority of which are IP camera-based for a multitude of reasons known to many end-users and the vast majority of security integrators and consultants.

The target market for HD Analog is those customers whose video surveillance upgrades, retrofits and expansions involve existing analog cameras, and ideally, largely reusable coax cabling infrastructure – where the analog technology can provide deployments that are significantly more security-effective and cost-effective.

For qualified customers and prospects, HD Analog surveillance capability enhancements – especially those that include the addition or expansion of video analytics capabilities – can be the top tier of an integrator’s high-ROI deployments, providing high returns to both integrator and customer.

For it to work, a system needs extensive analysis based on the customer’s existing security risk and analog video system infrastructure risk – primarily around cabling reuse, but also camera reuse. This can help determine the best applications for HD Analog camera deployments and video analytics to enhance security risk detection and incident response capabilities.

Ray Bernard, PSP CHS-III, is the principal consultant for Ray Bernard Consulting Services (www.go-rbcs.com). He is the author of the Elsevier book Security Technology Convergence Insights, available on Amazon. Follow Ray on Twitter: @RayBernardRBCS.